Using a Mortgage Calculator to Refinance Your Home

Mortgage interest rates are still low and are expected to remain at these reduced averages through 2021. However, some economic factors, like a possible recession and the Federal Reserve’s release of the adverse market refinance fee, slated for December 2020, could make interest rates gradually rise. It is important to know that homeowners are still in for great interest rates regardless of how these two factors play out.

There are many benefits of opting for a refinance, and these include:

- Lower interest rate

- Switch to an ARM

- Shorten loan term

- Consolidate debts

- Eliminate mortgage insurance

Speak to an Envoy loan originator near you!

You will want to submit your refinance application as soon as possible, so you can take advantage of low interest rates and avoid application backup should mortgage refinances rise in demand.

Since mortgage interest rates can change daily, it is important to lock your interest rate. This freezes the interest rate provided to you at that specific time. If you do not lock your rate it could fluctuate between the time you apply for the refinance and when you close.

If you are not ready to apply for a refinance, here are some ways you can stay prepared if mortgage rates continue to drop:

- Keep a healthy credit score

- Gather your paperwork

- Find out what your home is worth

- Save money for refinance fees

Ready To Get Started? Speak To An Envoy Loan Originator Today!

Why You Should Use a Refinance Calculator

Refinancing your mortgage doesn’t have to be a difficult process. We have many resources available like our free refinance calculator that can help you get started, so you can determine your new monthly mortgage payment.

How to Use Envoy’s Refinance Calculator

Using a refinance calculator can simplify your refinance process and help you organize your budget. You can use Envoy’s refinance calculator to calculate your new monthly mortgage payment and determine how much money you will save. It will also help you forecast how much interest you will pay over the life of the loan. You can even use a refinance calculator to capture comparison rates, so you can pick the right time to lock your interest rate.

Step One: Access Envoy’s Mortgage Payment Calculator

To access Envoy’s refinance calculator head to the Envoy website and click “Get Started” from the drop-down menu and select “Mortgage Calculators.”

Next, you will choose “Conventional Loan Mortgage Calculator” to begin calculating your refinance.

Step Two: Enter your Mortgage Information

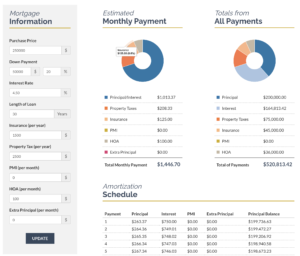

Now, you will begin typing in your current mortgage information. You can use the image below as an example.

Step Three: Review the numbers with your Envoy Loan Originator

The final step to complete before you begin your refinance application, is to review each of your loan options with your Envoy loan originator. During this assessment, your loan originator will run multiple side-by-side loan comparisons, so you can determine your best option in the current market.

Need more help? Get in touch with An Envoy Loan Originator Today!

Simplify Your Mortgage Refinance Process

Refinancing into a shorter loan term can help you save thousands over the life of the loan. With our free mortgage calculator and access to extensive loan education we can create a similar loan scenario for you like this example:

Let’s say that you bought a house in 2010 and you have a 30-year, 4.75% fixed rate mortgage of $300,000 and you are thinking of refinancing your loan. If you refinance your loan and decrease your loan term from 30 to 15 years and you take advantage of our current low interest rate of 3.50%, you could save $52,975 in interest over 15 years. Your monthly payment will increase an extra $311 each month, but look how much you will save in the long-run and how much faster you can build equity in your home.

Consider that if a 3.50% interest rate went up a quarter of a percentage point, your savings would decrease to $47,145 over a 15-year period, and your monthly payment would increase by $344.