Mortgage Blog

Loan Originators Receive a Redefined Role in 2019

According to Freddie Mac, due to a housing supply shift, more homeowners are beginning to age in their existing home rather than upgrade into a new home. Unfortunately, this shift makes it increasingly difficult for millennials to purchase inexpensive starter homes like previous generations.

4 Ways to Maximize Your Preapproval Power

Getting a preapproval will open a lot of doors for you during your home buying process, but you’ll still have to take steps to walk through them. Here’s a list of things you can do to make the most of your preapproval and find the right home faster:

Why Mortgage Rates Change

Getting a rate quote is useful in calculating your monthly payment, but always remember your rate isn’t set in stone until you lock it in. Mortgage rates change by the day—by the hour, even—so it’s crucial that you check in with Envoy to ensure the rate you may have been initially quoted is still accurate. Better rates might be available compared to when you began your home search.

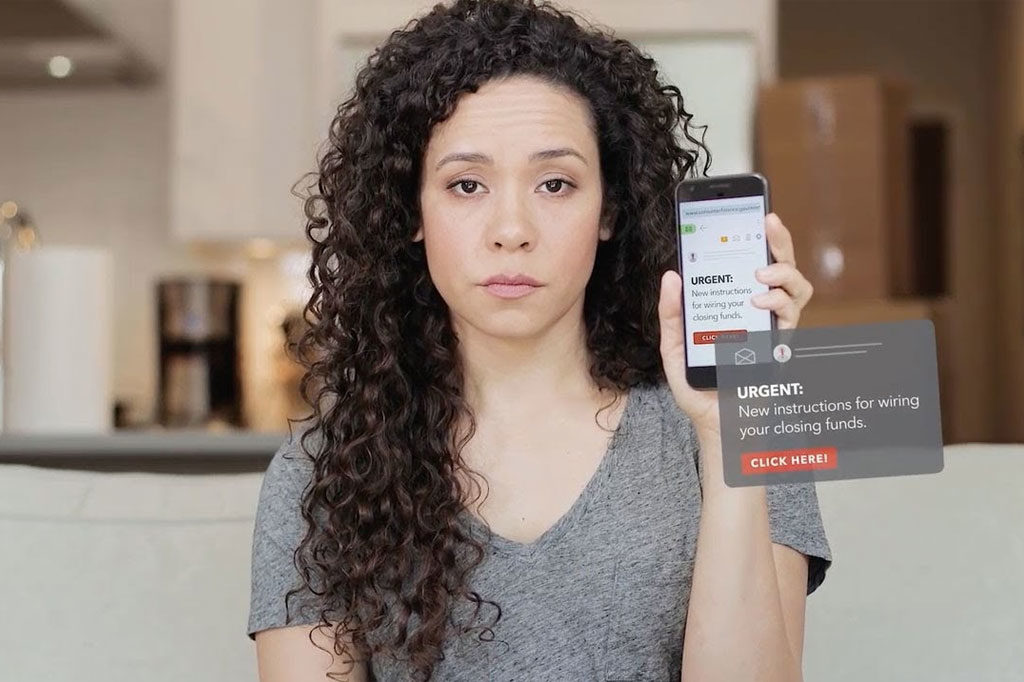

Mortgage Closing Scams: How to Protect Yourself and Your Closing Funds

Closing on a new home can be one of your most memorable life moments. It’s the final and one of the most critical stages in the home-buying journey, but with the exchange of key paperwork and a sizable down payment, it can also be a stressful experience, especially for first-time homebuyers.

Moving Up: Selling Your First Home and Buying Your Second

Selling your first home to purchase your “forever home” is exciting! When you bought your first home you were probably young, low on cash and had to give up some amenities to afford your own place. Now, you are older, most likely have some savings to work with and are ready to move into a home that is as unique as your needs and lifestyle. Here are a few suggestions that will help you find your forever home.

Smart Financial Moves all First Time Homebuyers Should Make

A good investment is something that will pay you more money than you paid for it. To turn your first home purchase into a money maker, it is important to crunch the numbers before you shop. Follow our guidelines to fine-tune your purchasing power and start making smart financial moves.